Market sentiment was largely optimistic when US President Donald Trump assumed office on January 20. However, less than a month into the new presidency, that optimism is beginning to wane with market uncertainty rising as his disruptive policies are keeping investors nervous.

This is the growing consensus among leading asset managers despite the fact that financial markets are holding up relatively well on a day-to-day basis this week following last week's tariff announcements on China, Canada, and Mexico.

While market reactions to the tariffs have been mixed, underlying concerns persist among asset managers and investors regarding the broader economic implications of his trade policies.

“The actions of the president are not only unsettling the markets but also failing to address the key concerns of householders. Consumer confidence has clearly taken a hit,” says Gary Dugan, chief executive officer of The Global CIO Office.

“Ironically, one of Trump’s central campaign promises was to combat inflation and restore consumers’ spending power. Yet, instead of easing financial pressures on middle- and lower-income households, his current policymaking, or the lack of it, could well be exacerbating the problems.”

Consumer confidence drops

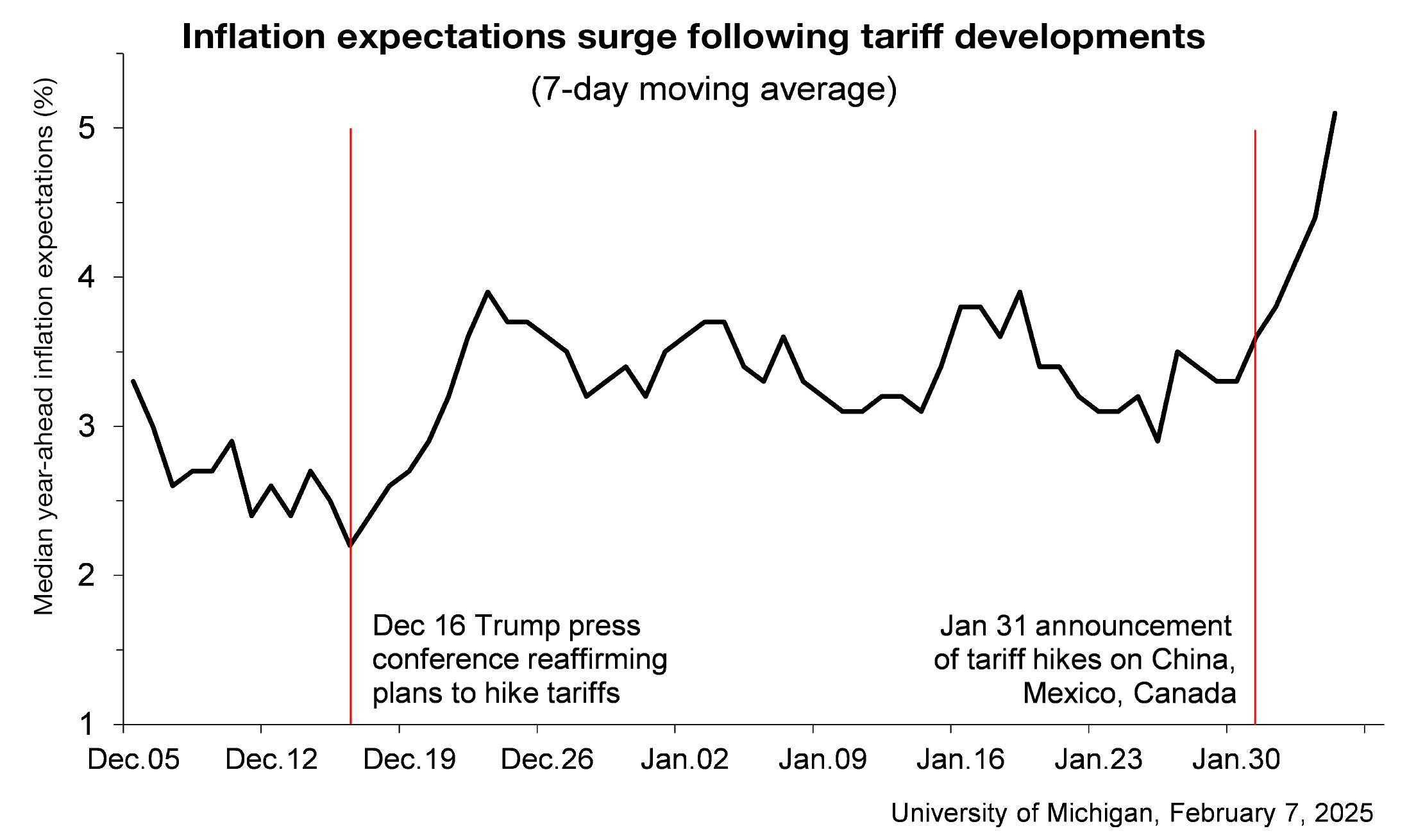

Dugan cites the latest University of Michigan consumer confidence survey which shows a sharp decline in consumer sentiment to 67.8 in January against market expectations of a reading of 71.8.

Inflation expectations rose sharply in January, the survey shows, with consumers anticipating a 4.3% inflation rate over the next year, sharply up from 3.3% in the previous month.

“This shift underscores growing concerns about purchasing power and economic stability – factors that could shape both investor behaviour and broader market trends in the months ahead,” Dugan says.

Nigel Green, CEO of global financial consultancy deVere Group, warns that the intensifying trade war threatens to trigger a sharp spike in bond yields as investors demand greater risk compensation.

“A surge in borrowing costs could hammer equities and send shockwaves through financial markets,” Green warns. “The administration is desperately hunting for cash. Trump’s tax cuts were colossal but lacked funding. The deficit is spiralling, and with no fiscal cushion, the White House is seizing tariffs as a revenue weapon.”

Green asserts that the timing of the tariffs is calculated. “Trump likely anticipates short-term economic pain, setting the stage for himself to play saviour later. It’s a deliberate strategy: engineer a crisis, then ride in as the solution. The pattern appears set: a self-inflicted shock to exert leverage and then a dramatic intervention to claim credit for resolving the fallout.”

“For investors, the consequences are clear: extreme volatility is now inevitable. Markets will be thrown into a whirlwind of erratic policy shifts, triggering violent swings across stocks, currencies, and bonds. The risk of a broader global slowdown is rising, as businesses delay investments amid uncertainty, and consumer sentiment weakens,” Green says.

He notes that when Trump imposed tariffs in his first term, supply chains were disrupted, corporate earnings took a hit, and retaliatory measures from trading partners led to further economic strain.

Bond market meltdown

In a webinar held on February 7, Green warned investors that a bond market meltdown, similar to what happened in the United Kingdom in October 2022, when the government lost confidence in former Prime Minister Liz Truss’ financial policies, which led to her resignation, could hit the United States by mid-2025.

Meantime, financial markets continued to remain calm on Tuesday ( Feb 11 ), with the Dow Jones Industrial Average ( DJIA ) closing at 44,593.65 points, marking a 123.24 point ( 0.3% ) increase from Monday, when it closed at 44,470.41 points, for an increase of 167.01 points ( 0.4% ) from the close last Friday. In contrast the Nasdaq Composite fell by 70.41 points ( 0.4% ) to close at 19,643.86 on Tuesday, while the S&P 500 remained nearly flat, rising slightly by 2.06 points to 6,068.50.

Other asset managers cite possible “tariff fatigue” as a reason for the market’s relatively positive performance – tariffs are still generally seen as just one in a basket of policies that also include extending tax cuts, reducing regulation, and fostering a pro-business environment.

According to Alex Grassino, global chief economist of Manulife Investment, Wall Street's broad expectation is that the US tariffs in their current form are unlikely to persist and that a much scaled-back version of them will more realistically be the final landing spot.

"Resist the urge to overreact to every breaking newsfeed or social media post. We get the sense that this is an initial salvo and that the actual implications for economies around the world may actually look very different," Grassino says in a market note issued on February 11.

However, Schroders senior US economist George Brown and head global economics David Rees, argue that Trump appears willing to accept the potential economic pain that the tariffs may cause in terms of stock market falls and higher prices for US consumers based on the way he has been using his platform, including social media, to explain them.

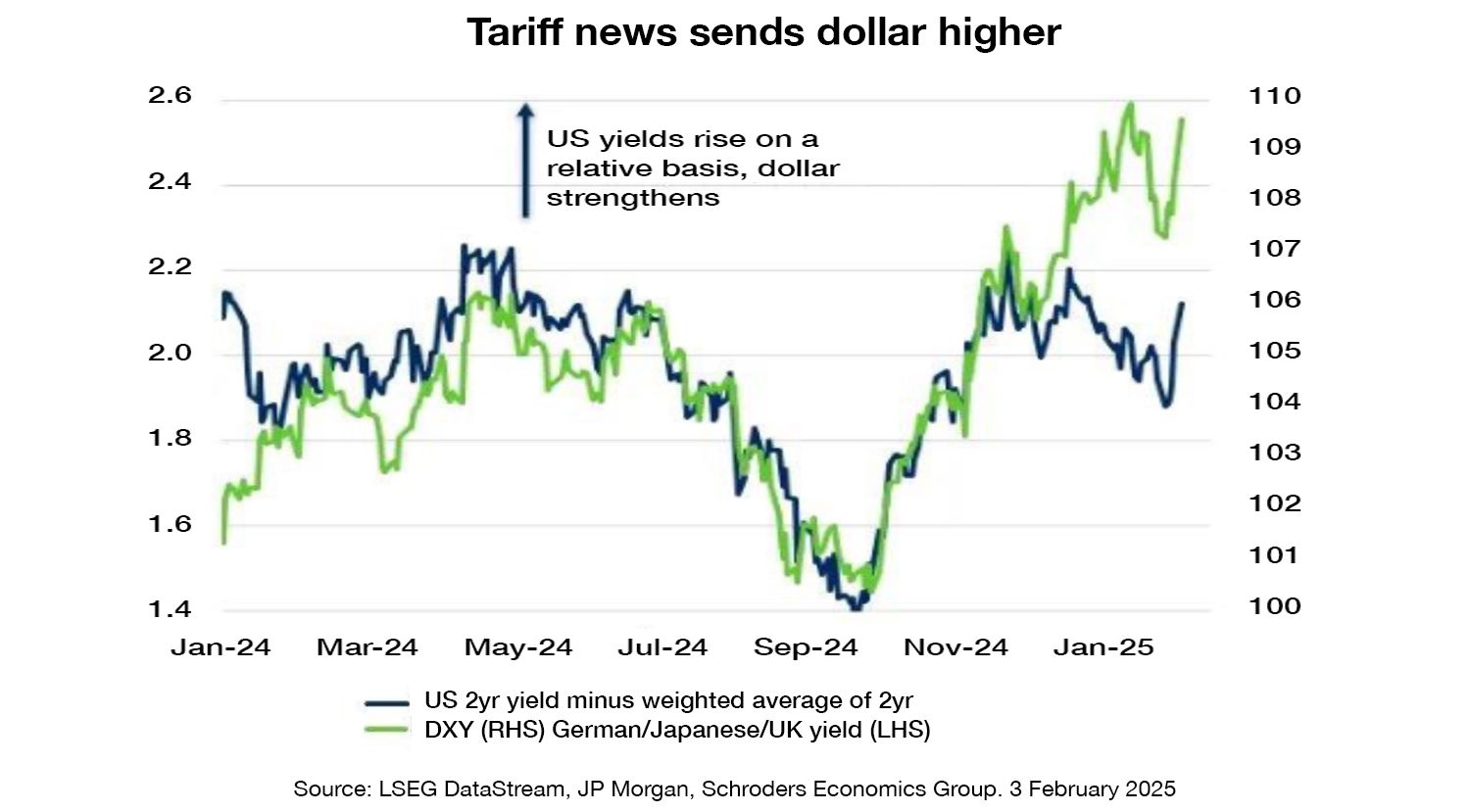

"From that perspective, investors cannot assume the tariff threats are purely a negotiating tactic. The market reaction ( when global shares fell and the US dollar strengthened on Febuary 3 ) shows the difficulty of assessing policies such as tariffs for investors. Financial markets are not waiting to discover all the details before pricing possible impacts and this is leading to increased volatility across asset classes," Brown and Rees says in their latest investment insights.

This sentiment is echoed by Lazard chief market strategist Ronald Temple who says: "I view the events of the last week as a key turning point for investors, many of whom had discounted the likelihood that the new administration would impose tariffs based on inflation and growth concerns. I see these announcements as commencing a potentially extended period of uncertainty that will command much attention from investors and C-suite executives."

Despite the relative calm in financial markets so far this week, concerns are growing about the prospects of elevated inflation and slowing growth.

The Peterson Institute for International Economics estimates that maintaining a 25% tariff through to 2029 could reduce the US gross domestic product ( GDP ) by US$190 billion, while the Brookings Institution projects that the tariffs would cause inflation in the US to rise by over 1.3 percentage points and job losses to reach 177,000 to 400,000 should Canada and Mexico retaliate.

Pimco also warns that tariffs on Canada, Mexico, and China alone could raise US inflation by 0.8 percentage points and reduce economic growth by 1.2 points in the first year.