China’s property crisis has persisted for years, weighing down on economic growth. However, as real estate remains one of the most important household assets and a significant contributor to GDP, authorities continue implementing measures, including fiscal incentives, to stabilize the market.

There are early signs that property sales are bottoming out in key provinces, while policies aimed at boosting consumption are also expected to aid the recovery of the commercial property sector.

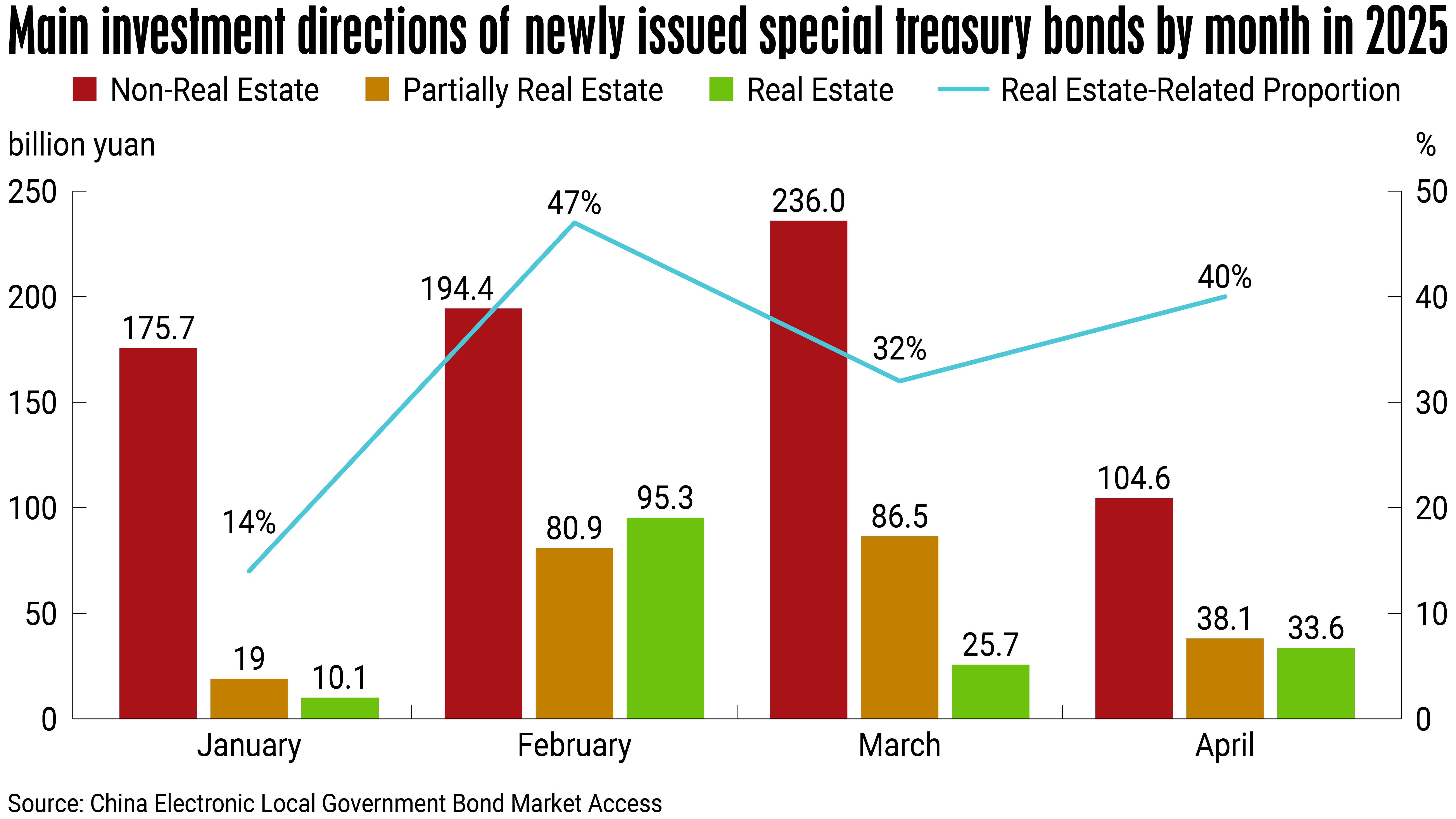

In April, local governments issued 176.3 billion yuan ( US$24.4 billion ) in new special-purpose treasury bonds, including 71.7 billion yuan directed at real estate-related sectors – that’s 40% of the total and an 8 percentage point increase from the previous month. Of this, 33.6 billion yuan explicitly targeted real estate, a 30% increase from March, according to the China Real Estate Information Corporation ( CRIC ).

From January to April, a total of 1.1 trillion yuan in special-purpose treasury bonds was issued, of which 389.1 billion yuan, or 35%, was allocated to real estate-related sectors.

Although the total issuance of special-purpose treasury bonds declined month-on-month, the portion explicitly directed towards real estate continued to grow by 30%. A key driver of this trend has been the significant increase in land reserve-related special bonds. Land reserve special bonds reached 21.0 billion yuan in April, the second-highest monthly total year-to-date, according to CRIC.

As of April, Guangdong led the country in real estate-related special bond issuance, with 161.8 billion yuan, followed by Shandong with 138.1 billion yuan. Among first-tier cities, Beijing ranked fifth with 57.2 billion yuan while Shanghai ranked 17th with 22.7 billion yuan, CRC data shows.

In terms of floor area, newly sold commercial residential housing nationwide reached 218.69 million square meters in Q1 2025, down 19.3% from Q4 2024 and 3.0% year-on-year. The total sales value reached 2.08 trillion yuan, a 25.4% decline from the previous quarter and a 2.1% year-on-year decrease.

However, the year-on-year decline in both indicators narrowed each month, improving by 9.9 and 15.0 percentage points, respectively, compared to the end of the previous year.

By property type, the declines in residential housing sales area and value were more limited, at 2.0% and 0.4%, respectively.

By region, the central provinces were the first to show positive growth in sales area, increasing 0.7% year-on-year, with a relatively modest drop in sales value ( -1.8% ). Other regions continued to see declines in both indicators. The eastern provinces experienced the largest decrease in sales area, down 4.5% year-on-year, although they still accounted for 43.9% of national sales area and 59.7% of sales value.

Consumption incentives

The 2025 consumption enhancement campaign aims to boost consumer spending across all sectors and optimize the consumption environment. China’s retail market is undergoing a structural transformation, as consumer preferences shift towards quality, personalization, social interaction, and experiential consumption. These evolving expectations are pushing retail operators to upgrade and diversify their offerings.

In addition, the expansion of infrastructure real estate investment trusts ( Reits ), including consumer infrastructure, has significantly boosted investor interest in the retail sector. According to a report from real estate company Cushman & Wakefield ( C&W ), total investment in real estate development reached 10 trillion yuan ( US$ 1.38 trillion ) in 2024, down 10.6% from the previous year. However, commercial retail projects accounted for 14.85% of the total investment, up from 10% in 2023. This trend is expected to persist in 2025.

Over the past two years, economic headwinds have led to reduced office leasing demand across China. In many cities, rents have declined and vacancy rates have increased.

However, the central government’s renewed focus on the “platform economy, or the growing dominance of digital platform-based business models, is expected to help drive new employment opportunities and expand consumption. This, in turn, will likely support demand for office space and industrial park facilities, says the C&W report.

Looking ahead, office space demand in the country is expected to grow this year. In some cities, office rental levels are projected to bottom out and stabilize in the second half of this year.

Moreover, the anticipated expansion of the Reit market, which includes office building assets, is expected to unlock significant potential in the commercial real estate sector, especially when paired with continued growth in emerging and future industries, the report says.